Maxint

Maxint acts as a personal financial analyst for users, helping them manage their financial matters more efficiently by making sure they are kept up to date with their transactions, budget, and net worth.

It assists users in achieving their financial goals by organizing their transactions and crafting budgets. Maxint can connect to various banks, aiding users in tracking their net worth across income, expenses, assets, liabilities and equity accounts in real-time.

The app is equipped with budgeting features, providing immediate insights into spending by category, merchant, location, or custom tags, while allowing users to set goals.

Maxint makes personalized recommendations for deposit accounts and credit cards based on users' needs. The tool is available on all major platforms including iOS, Android, MacOS, Linux, Windows, and Web, ensuring convenience and ease of use across devices.

Data security is a priority, so multi-factor authentication and end-to-end encryption are implemented for user protection. One of the unique features of Maxint involves the use of artificial intelligence (AI).

The AI acts as a financial analyst, categorizing transactions, sending bill notifications, and providing insightful understanding of your financial behavior.

Releases

Pricing

Prompts & Results

Add your own prompts and outputs to help others understand how to use this AI.

-

836,273636v1.6 released 15d agoFree + from $12/mo

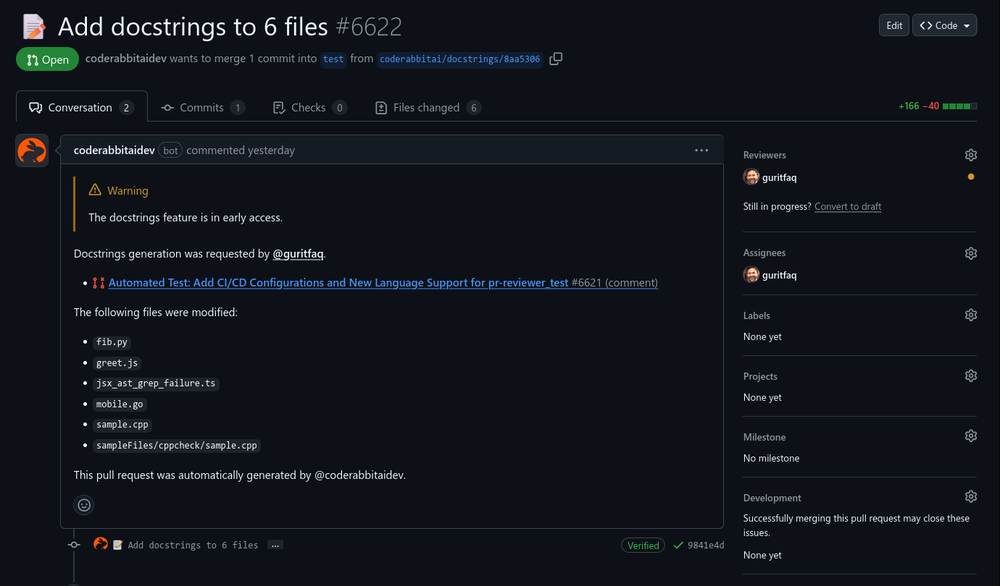

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs -

28,815395v1.0 released 11mo agoFree + from $35/mo

This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

Pros and Cons

Pros

View 19 more pros

Cons

View 4 more cons

7 alternatives to Maxint for Financial advice

-

Transform financial data into visual insights.17,483473Released 2y agoFree + from $20/moThere isn't a way to upload an Excel file or copy/paste. what's the point if you have to re-enter everything?

-

AI-powered financial advice for smarter decisions6,917166Released 8y agoNo pricing

-

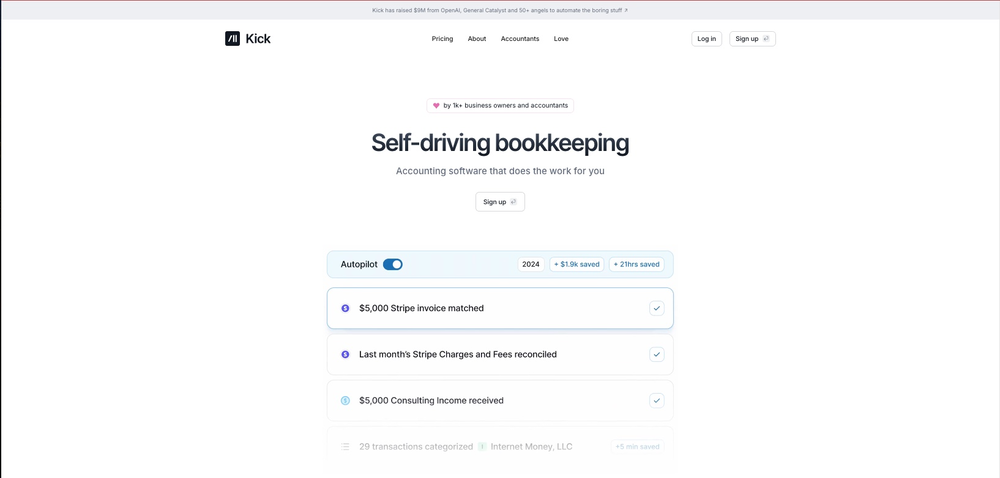

Automate your finances with AI agents.2,94540Released 2y agoFree + from $14.99/mo

-

AI-powered financial advisor for everyone2,47941Released 1y agoFree + from $3.99/mo

-

Personalized financial management & advice.1,79611Released 1y agoNo pricing

-

AI assistant for smarter money management1,72320Released 1y agoFree + from $7.62/mo

-

AI-driven finance assistant for banking and investment69714Released 1y agoFree + from $29/mo

Q&A

If you liked Maxint

Featured matches

-

The fastest way to spot inefficiencies in your client's workflows and techOpen140,787307v1.5.1 released 1mo agoFree + from $34/mo

Just implemented your instruction out how to run drip campaigns automatically, nice! Getting prospect calls coming in

Just implemented your instruction out how to run drip campaigns automatically, nice! Getting prospect calls coming in -

30,17437v2.0.0 released 3mo agoFree + from $15.0/mo

MD Shahab, thank you for reporting the bug. That shouldn't have happened, and I'll investigate the issue. If it fails again, please try re-running the same query - this isn't a common occurrence. Since it's an agent-based system, it may take some time to combine responses from all sources.

MD Shahab, thank you for reporting the bug. That shouldn't have happened, and I'll investigate the issue. If it fails again, please try re-running the same query - this isn't a common occurrence. Since it's an agent-based system, it may take some time to combine responses from all sources.

How would you rate Maxint?

Help other people by letting them know if this AI was useful.