Private Equity List

The Smarter Way to Find PE/VC Investors

Most popular alternative: CapitalConnector (14 saves)

Private Equity List (PEL AI) is your dedicated, AI-powered search engine for discovering verified Private Equity and Venture Capital investors. Unlike generic tools like ChatGPT or Claude, which offer surface-level or outdated information, PEL AI gives you real-time, human-curated data on active funds worldwide.

Whether you’re raising a seed round, Series A, or late-stage capital, PEL AI delivers targeted results instantly. Just enter a query like “Fintech VC funds in Europe” or “Top PE firms investing in biotech,” and get a refined, actionable list — no fluff, no guessing.

PEL AI is built on proprietary data, verified manually and updated weekly. You’re not talking to a chatbot. You’re tapping into a professional-grade investor directory with filters for sector, stage, region, and thesis. From edtech in Germany to healthtech in the UK, you’ll find investors in regions and niches that other tools miss.

Looking for new funds? Use the PEL Feed to track the latest active PE/VC funds added in the last 12 months. Need inspiration? Browse pre-set query templates and get results in seconds.

Save hours of research. Get investor intelligence that’s focused, fast, and reliable — all from a purpose-built tool designed for startups, founders, analysts, and dealmakers.

Whether you’re raising a seed round, Series A, or late-stage capital, PEL AI delivers targeted results instantly. Just enter a query like “Fintech VC funds in Europe” or “Top PE firms investing in biotech,” and get a refined, actionable list — no fluff, no guessing.

PEL AI is built on proprietary data, verified manually and updated weekly. You’re not talking to a chatbot. You’re tapping into a professional-grade investor directory with filters for sector, stage, region, and thesis. From edtech in Germany to healthtech in the UK, you’ll find investors in regions and niches that other tools miss.

Looking for new funds? Use the PEL Feed to track the latest active PE/VC funds added in the last 12 months. Need inspiration? Browse pre-set query templates and get results in seconds.

Save hours of research. Get investor intelligence that’s focused, fast, and reliable — all from a purpose-built tool designed for startups, founders, analysts, and dealmakers.

Show more

Releases

Get notified when a new version of Private Equity List is released

Notify me

September 21, 2025

Private Equity List creator

Initial release of Private Equity List.

Pricing

Pricing model

Freemium

Paid options from

$99/month

Billing frequency

Monthly

Prompts & Results

Add your own prompts and outputs to help others understand how to use this AI.

Private Equity List was manually vetted by our editorial team and was first featured on September 21st 2025.

-

807,613632v1.6 released 7d agoFree + from $12/mo

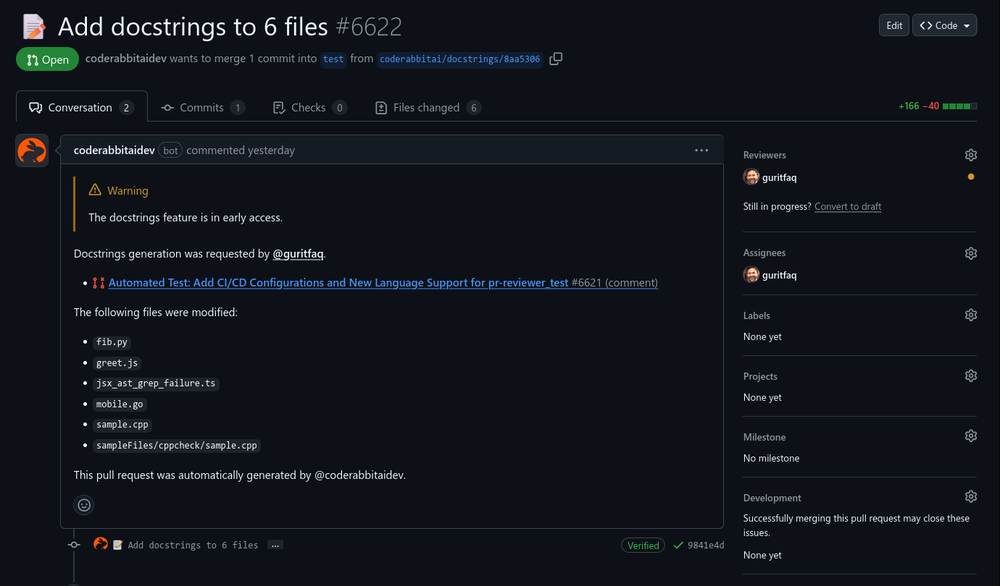

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs -

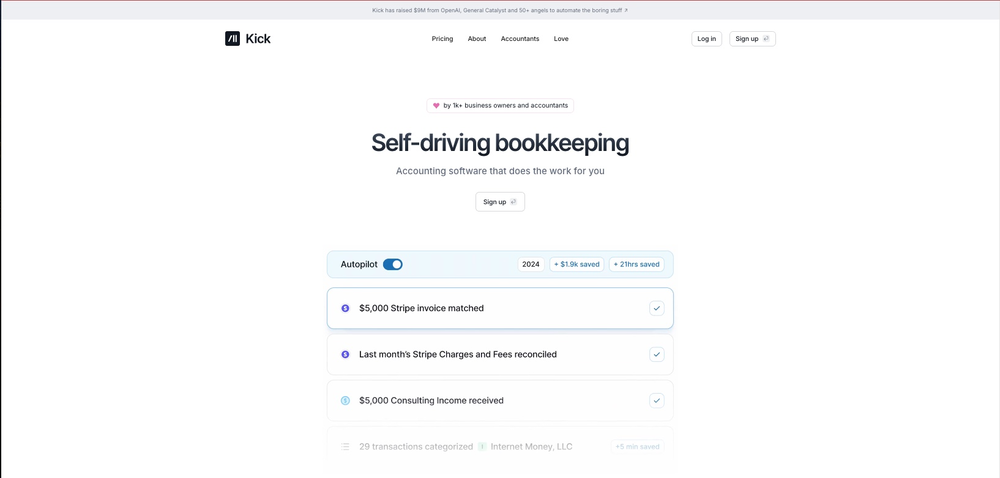

28,516391v1.0 released 11mo agoFree + from $35/mo

This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

Pros and Cons

Pros

Verified and curated investor data

Real-time updates on new funds

Sector and region-specific filters

Purpose-built for PE/VC search

Fast and easy-to-use interface

Cons

Limited to PE/VC (not general investors)

Requires manual query input

May miss very new or stealth funds

Learning curve for first-time users

AI suggestions may need user review

3 alternatives to Private Equity List for Investor search

-

Connect with 75,000 investors in seconds.30214Released 2y agoFree + from $24/mo

-

Connect with 50,000+ VCs and angels using AI-powered matching1783Released 1y agoFrom $69.99/mo

-

AI-powered matchmaking for startups and investors1785Released 11mo agoFree + from $29/mo

Q&A

What does PEL AI do?

PEL AI is an AI-powered search engine for discovering verified Private Equity and Venture Capital investors. It delivers targeted results instantly, just by entering a query, providing a refined, actionable list of investors.

How can PEL AI assist in raising a seed round?

PEL AI aids in raising a seed round by offering relevant, verified, and real-time data on active funds worldwide. It allows the user to tap into a professional-grade investor directory with filters for sector, stage, region, and thesis.

What makes PEL AI different from ChatGPT or Claude?

PEL AI differs from ChatGPT and Claude in that it provides real-time, human-curated data on active funds and doesn't give surface-level or outdated information. PEL AI lets users access a high-quality investor directory.

How is PEL AI updated with data?

PEL AI is updated via its proprietary data, which is verified manually and updated on a weekly basis.

What kind of filters does PEL AI provide for investor directory?

PEL AI provides filters for its investor directory that allow for specificity in searches. The filters include sector, stage, region, and thesis.

What regions and niches does PEL AI cover?

PEL AI covers diverse regions and niches worldwide. It caters to needs like edtech in Germany and health tech in the UK, finding investors in regions and niches that other tools often miss.

+ Show 14 more

Ask a question

How would you rate Private Equity List?

Help other people by letting them know if this AI was useful.