What are the roles of AI agents in WorkFusion?

The AI agents in WorkFusion have various roles. These include AML analysts, sanctions and adverse media screening analysts, transaction screening analysts, and customer identity program analysts, amongst others.

In what ways does WorkFusion's AI tool ensure adherence to BSA/OFAC requirements?

WorkFusion's AI tool ensures adherence to BSA/OFAC requirements through incorporated aspects such as sanctions screening, transaction screening, and negative news investigations. These tools provide a comprehensive approach towards fraud prevention.

How does WorkFusion's tool perform sanctions screening?

WorkFusion's AI tool undertakes sanctions screening by using AI agents to review sanctions, negative news and PEP alerts 24/7, reducing the risk of human error and freeing up human team members for other tasks.

How does WorkFusion's AI tool help in catching negative news?

WorkFusion's AI tool helps in catching negative news through its adverse media monitoring functionality. The AI agents are capable of streamlining investigations of negative news to reduce the risk of regulatory penalties.

How does WorkFusion enhance customer service using AI?

WorkFusion enhances customer service using AI by handling customer inquiries quickly and efficiently. AI agents can classify emails and attachments and route them to the appropriate internal teams, streamlining the process and thereby improving response times.

What's the functionality of WorkFusion's AI tool in customer lifecycle management?

WorkFusion's AI tool assists in customer lifecycle management by classifying emails and attachments and routing them to relevant internal teams for a prompt response. This ensures a seamless customer service experience.

How does WorkFusion's AI tool reduce manual work in the KYC process?

WorkFusion's AI tool reduces manual work in the KYC process by automating the process using AI digital workers. This lowers risks and delivers a faster and more efficient onboarding experience for customers.

How does WorkFusion's AI tool classify emails and attachments?

WorkFusion's AI tool classifies emails and attachments using AI agents. These agents scan content, classify it based on pre-set parameters, and route them to the relevant internal teams.

How does WorkFusion's tool ensure customer inquiries are dealt with promptly and efficiently?

WorkFusion's AI tool manages customer inquiries efficiently by using AI agents. These agents handle inquiries quickly and at high volumes, ultimately leading to elevated customer satisfaction levels.

Does WorkFusion's AI tool assist in risk mitigation?

Yes, as part of its comprehensive suite to combat financial crime risk, WorkFusion's AI tool does assist in risk mitigation. It utilizes AI digital workers to manage various aspects of AML compliance thereby mitigating the risk associated with financial crimes.

What are some examples of AI agent roles in AML compliance?

WorkFusion utilizes specialized AI agents that undertake crucial AML compliance roles. These include AML analysts who analyse transactions and suspicious activity, sanctions and adverse media screening analysts who monitor sanctions lists and adverse news, transaction screening analysts who scrutinize transactions, and customer identity program analysts who verify and validate customer identities.

Could you elaborate on the customer identity program analysts?

The customer identity program analysts in WorkFusion are AI agents who are in charge of verifying customer identities. They play a crucial role in tokenizing, removing PII from documents, confirming that identification documents are unaltered and legitimate, corroborating customer details against trusted data sources, and categorizing and routing them accordingly.

How does WorkFusion's AI tool help to scale compliance teams?

WorkFusion's AI tool helps to scale compliance teams by employing AI digital workers. These agents perform compliance-related tasks such as AML analysis, sanction and adverse media screening, transaction screening, and customer identity verification. This reduces the workload for human team members and allows for the swift expansion of the compliance team as necessary.

What does the term 'combat financial crime risk' mean in the context of WorkFusion's AI tool?

In the context of WorkFusion's tool, 'combat financial crime risk' refers to the mitigation and prevention of financial malpractices, which include but aren't limited to money laundering, fraud, and illicit transactions. The tool uses AI digital workers who are designed to manage various aspects of AML compliance, thereby reducing the risk of such financial crimes.

Can I build my own Digital Worker using WorkFusion's AI tool?

Yes, WorkFusion provides a facility to build a custom digital worker. This offers flexibility and adaptability to meet unique business needs and requirements.

Can you tell me more about WorkFusion's AI tool for Customer Lifecycle Management (CLM)?

WorkFusion's AI tool for Customer Lifecycle Management (CLM) routes customer inquiries promptly to internal teams by classifying email and attachments. This allows the personnel to resolve customer inquiries quickly, maintaining high service standards.

How does WorkFusion's AI tool manage customer inquiries efficiently?

WorkFusion's AI tool manages customer inquiries efficiently by classifying and routing email inquiries and their attachments using AI agents. The tool helps to handle high volumes of customer inquiries with speed and ease, hence optimizing the customer service experience.

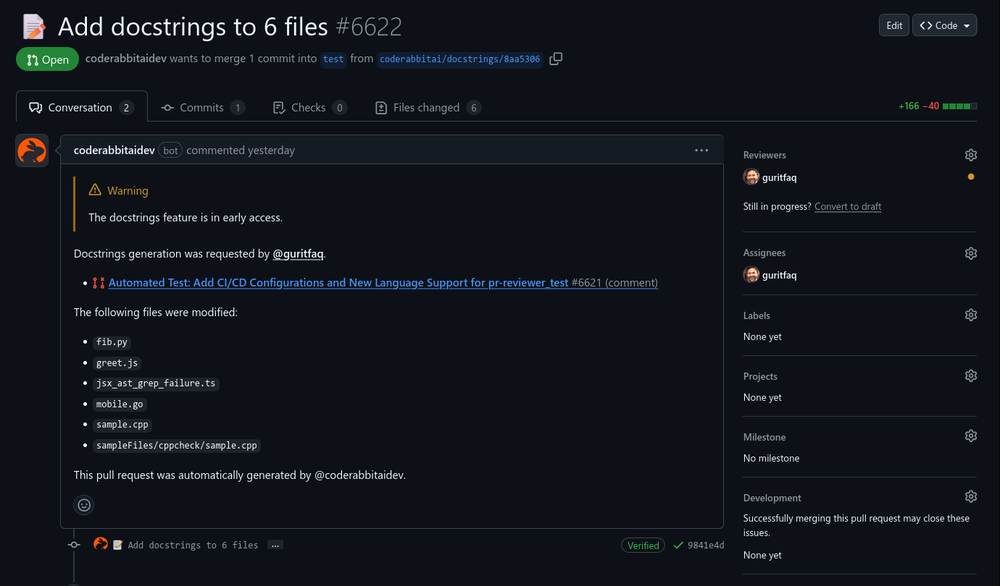

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs

Reducing manual efforts in first-pass during code-review process helps speed up the "final check" before merging PRs This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

This team took the time to understand the industry, problem and its users and designed a perfectly engineered solution. Kudos.

How would you rate WorkFusion?

Help other people by letting them know if this AI was useful.